Thank you!

We are grateful for the generosity and compassion of our community supporters that donate nearly $3,000,000 annually to provide the funds needed to serve more than 8,000 children, adults, seniors and veterans struggling in our community.

St. Vincent de Paul Society of Marin County is a charitable nonprofit 501(c)(3) organization. Our Federal Tax Identification number is 94-1207701. We never sell, trade or share donors contact information with anyone else for any purpose.

Join Our Legacy Circle

When you name St. Vincent de Paul Society of Marin County as a beneficiary for either a percentage or specific dollar amount in your will, I.R.A. or estate plan, your bequest will ensure that Marin County residents facing the harsh realities of poverty will always receive comfort and assistance. If you notify us of your plans, we look forward to inviting you to our annual Legacy Circle luncheon with our Executive Director, Board President, and Chief Philanthropy Officer. Federal Tax I.D. # 94-1207701

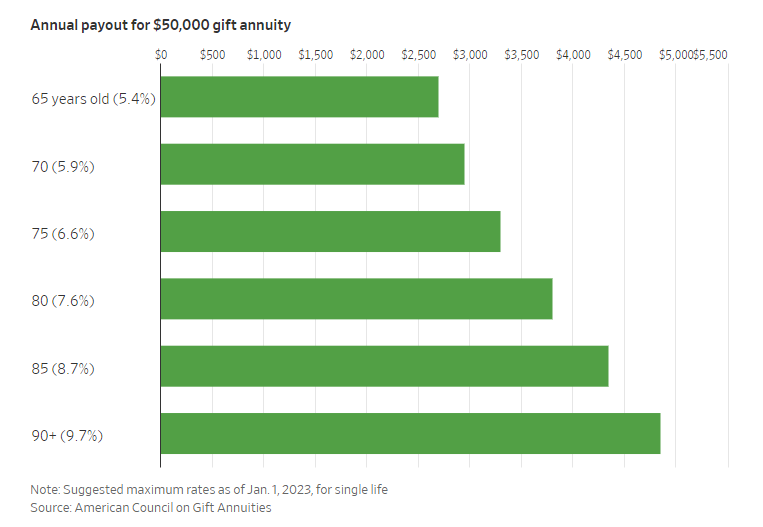

Did you know retirees age 70½ or older are able to donate up to $50,000 from their IRAs to fund gift annuities and get back monthly retirement paychecks at fixed rates of up to 9.7% depending on your age?

The gifts count toward required minimum distributions, the annual withdrawals older Americans must make from retirement accounts. Normally these withdrawals are taxed as income, but when directed to charity they are tax-free. In exchange for your kind gift, SVdP agrees to make fixed annual payments to the giver. Any money left over at the end of your life will be donated to SVdP.

What are the tax benefits of an IRA-funded charitable gift annuity?

The IRA withdrawal doesn’t count as income, and it can count toward any required minimum distribution amount for the year. The IRA owner gets a minimum payout of 5% annually, taxed as ordinary income.

Are there restrictions on the donations?

IRA-funded gift annuities come with special rules. A donor can make the gift in one tax year only. That could be one $50,000 gift, or several smaller gifts up to the $50,000 limit. The $50,000 amount counts toward a separate $100,000 limit per taxpayer for outright gifts to charity made with IRA dollars. The annuity can make payments to the donor or to the donor and spouse only. Payments have to start within a year of funding it.

How safe is a gift annuity?

When St. Vincent de Paul issues a gift annuity, we are pledging our assets to back it. We will continue to make payments for the entirety of your life.

Need more information?

Please contact our Chief Philanthropy Officer Kathleen Woodcock at kwoodcock@vinnies.org or call (415) 297-6587.